Ben Legg

There’s a certain mythic aura that surrounds the notion of the crowdfund – a fairytale of the purpose-driven startup getting boosted to astounding levels of success on the shoulders of its passionate and devoted fans.

For some businesses, that does happen – for example when Monzo Bank raised £1million in just 96 seconds. However, for most, running a successful crowdfund is a long and arduous grind; one that takes far more time, resources and money than you probably realise – and with a relatively low chance of success.

Founders are highly-driven, scrappy people, which is why many think they can overcome these obstacles through sheer determination, brains and a great team effort – and if that’s the case, things like time and money might not hold you back.

Of course, if your crowdfund is successful, there are plenty of tangible benefits. It’s a great way to share the value created with the people who use it the most. A good crowdfund can also grow brand loyalty. So before you get started, you should get a clearer picture of how much work really goes into planning and running a crowdfund – it’s something we wish we had known before diving headfirst into launching our own campaign for The Portfolio Collective.

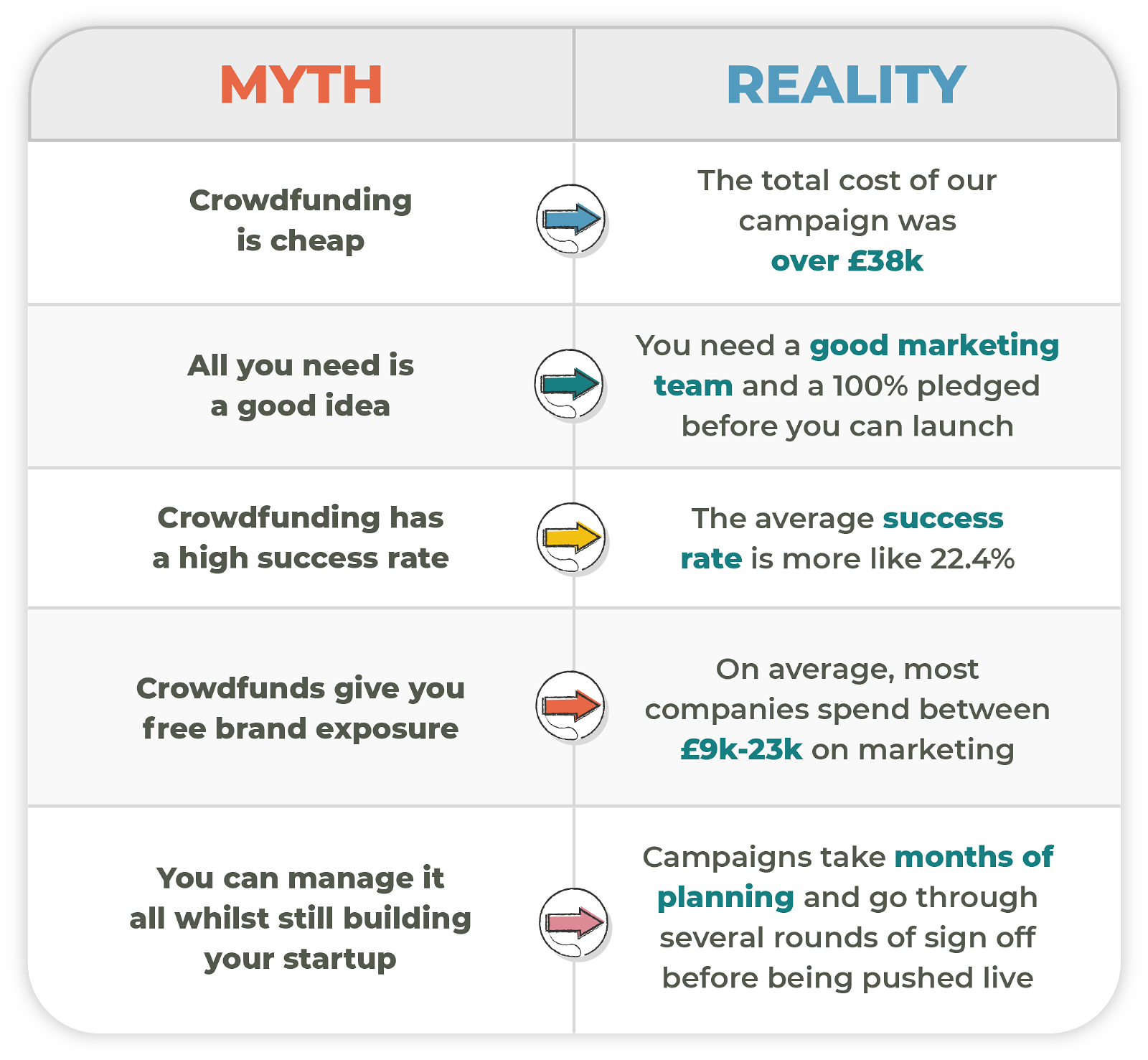

Debunking the myth of the crowdfund

In recent years, equity crowdfunds have gained a lot of popularity. It wasn’t always that way. Not that long ago, crowdfunding was seen as a last resort for startups – it meant that VCs weren’t interested, so you had to find investment elsewhere. Yet as young businesses became more innovative in their fundraising and well known unicorns started to pave the way, the crowdfund exploded with new life.

In 2019, it was estimated that nearly 6.5 million crowdfund campaigns were hosted globally, and that number is expected to triple by 2025.

Despite this incredible growth, there are still plenty of misconceptions floating around about the crowdfund experience – myths that most startups don’t even know to look out for. When we started our campaign, we had high hopes of smashing our targets in just a few days – because those are the expectations set by success stories like Monzo, Allbirds and Brewdog. Needless to say, that was not our experience.

Though we did successfully surpass our target, we, like many others, let our excitement get the best of us. Now, we want to help others understand what you’re really signing up for. Since closing our campaign, we’ve gathered our learnings – plus advice from other founders who’ve been through it before – to help startups make more informed decisions.

Here are a few misconceptions to look out for (and the realities you should be aware of).

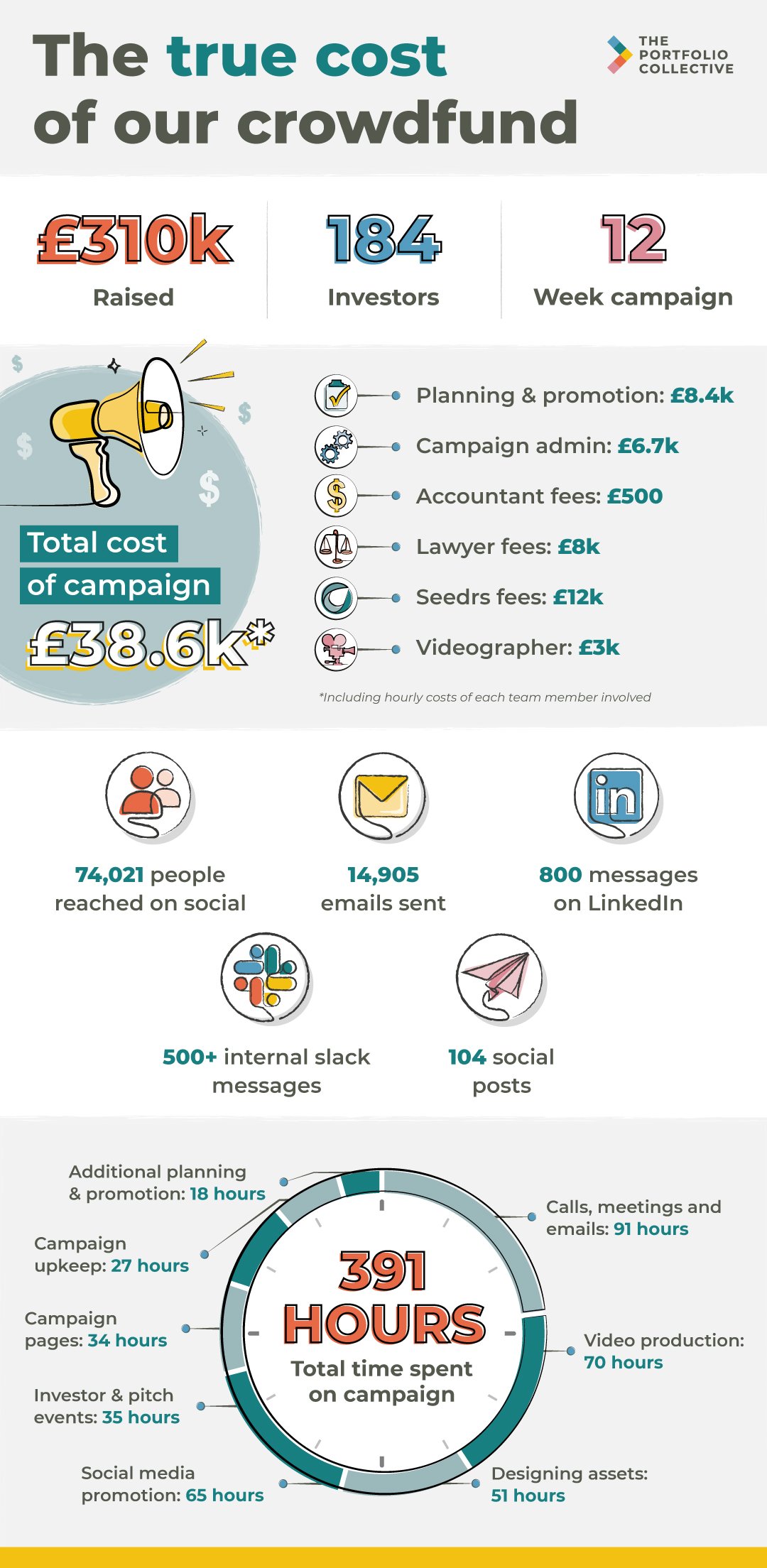

The real cost of a crowdfund (from a team with the scars to prove it)

Let’s zoom in on that first misconception: crowdfunding is cheap. At first glance, it would seem that way. All you have to do is create a catchy campaign page and post about it on social media, right? Wrong.

As an online community, we were excited by the prospect of helping our members invest. Many had been asking to do so for months, and what could be better than having our biggest fans become stakeholders in our growing business? Since day one, our members have been passionate, devoted champions for our mission, and they played a huge part in helping spread the word about the new future of work that we’re driving. So when we decided to do a crowdfund, we assumed that this passion would spread like wildfire. What we didn’t realise was how much work was involved in getting our message out there and selling that dream.

What we learned, rather quickly, was that crowdfunding is expensive – and it is very time consuming.

The good, the bad and the ugly side of crowdfunding

We’re not saying crowdfunds are terrible or a bad investment. However, it definitely cost more money than we realised, and took longer to organise and run than we expected. That said, we did raise £310k and it was a good way for us to get our community even more involved in the future of our business. In many ways, that made it all worth it. Yet if we had been one of the 78% of startups whose crowdfunds fail, we would have just wasted £38,000 and 400 hours.

As they say, hindsight is 20/20 and if you asked us if we’d do it again, we’d probably start off our response with a resounding “yes, but…”

So before you kick off your planning and start rallying the troops, here are a few things we learned from our experience, which may make yours a little less shocking.

1. It’s a good way to reward your early adopters and most loyal users

When we started our crowdfund, we already had a dedicated community of professionals who were chomping at the bit to invest in a platform that was supporting their careers. As our campaign progressed, more of our occasional users started learning about our plans through our social media promotion, recommendations from members and general word-of-mouth – and that’s what tipped them over the edge and convinced them to invest.

A good crowdfund campaign will get your message in front of the right people. Once they become financially invested in your success, they’re more prone to be ambassadors for what you do. Of course, not everyone who joins will be a superfan, but they’re more likely to engage with your product or service and help spread the message to ensure continued success.

2. It keeps your cap table clean

A ‘cap’ (or capitalisation) table is a listing of a company’s investors and all their holdings. When you have dozens of investors from several rounds of funding, share transfers, stock options, and VCs all in one place, your cap table can quickly grow and get messy, making it difficult to manage (e.g. getting signatures for key documents).

With a crowdfund, all the investors you gain from that campaign get lumped together into a single shareholder (all on the same terms). So rather than having to add 100+ investors to your cap table, you just add one – keeping things neat, tidy and easy-to-manage.

3. Crowdfunds are highly regulated

Crowdfunds attract retail investors who are pledging their hard earned savings. They may feel comforted to know that the process is governed by an official financial body like the FCA (Financial Conduct Authority) and that their investment is protected (to an extent, as all investment comes with some level of risk).

What we didn’t expect was how much sign off (by lawyers) would be required for our campaign collateral – including every social media post and email. With regulation comes limitations regarding what you can (and can’t) say. Your standard hyperbolic marketing language is a no-go. That means no claims of being “the world’s best” or the “fastest growing” unless you can back those claims up with cold hard figures from a respected source.

4. Most cheque sizes are small, so you need to secure big investors to make the numbers

Crowdfunding platforms want to host campaigns with a good chance of success. For our campaign, we had to secure commitment from investors exceeding 60% of the crowdfund target before we were allowed to formally launch to the public. We found the quickest way to do that was through lining up a few larger angel investors.

Once the campaign actually went live, we had 84 investments of less than £100, which proves that a lot of crowdfund investors like to place lots of small bets on a diverse range of companies rather than one big investment on a particular startup. Though flattering, these don’t add up to much. That’s why you need to find enough investors who write cheques in the thousands (and more).

5. You need to have a good campaign video

According to Indiegogo, campaigns with videos generate 144% more funding than those without. That’s because a video can convey a lot of information in a short amount of time and deliver your pitch in a way that emotionally connects with viewers. It will also reduce the number or requests for face-to-face meetings, as potential investors feel like they already know the founders.

More often than not, your video is the first thing investors engage with when they land on your campaign web page. That’s why a well produced video is the best way to generate interest and display your plans for future development. The bad news? It can cost quite a bit of money and time to do it right (ours cost over £5k to plan, film and edit). Your video will also have to go through several rounds of signs off and there will be lots of restrictions in place around what you can say due to FCA regulations – so be prepared for plenty of rewrites, re-edits and back-and-forth with the lawyers from your crowdfunding platform.

Despite all that, we would say it’s definitely worth it when you take into consideration the fact that conversion rates increase by 80% when you use video content.

6. There are a limited number of calendar windows in which you can launch

Many crowdfunds are timebound by the platform (ours was capped at 30 days) so you shouldn’t launch your campaign when people are distracted. Ideally you would want to run your crowdfund during a time when people are most likely to be reading emails, engaging with social media and just generally paying attention to business communications. That means periods like Christmas and school vacations are risky.

Realistically, the best times to launch a crowdfund are late January or late September. Possibly late April as well, though this comes with the risks of early summer distractions.

7. You WILL get bogged down in the legals, fees and platform terms

Equity crowdfunding is often more appealing to entrepreneurs and startups because it means they don’t have to give up board seats or impose restrictive terms on themselves. What a lot of startups don’t realise is how much legal work goes on behind the scenes and how much of the funds raised get taken in fees by the crowdfunding platforms.

For our crowdfund, we used Seedrs, who charge a success fee of either 7% of all funds raised or £12,000 (whichever is larger) – only if your campaign is successful, of course. On top of that, there’s a completion fee, a payment processing fee and the fees that are charged to investors when they commit.

In terms of legal work, platforms like Seedrs are required to do a lot of due diligence on the startups and campaigns they’re hosting. That means you’ll have to work closely with their lawyers (plus your own) to make sure your legal structures are sound, your financials are compliant and you have contractual protections in place.

After the crowdfund ends, there’s even more legal fees (which may come as a surprise if you’re not prepared) and work required to get the money released. That means it may be a few weeks or months before you can access the funds you raised.

8. The risk of failure is high

There’s no guarantee that your crowdfund will reach its target. In fact, the average success rate for US crowdfund campaigns is only 23% (includes raising for non-profit organisations as well as for-profit). When you think about all the money and time you put into organising and running a crowdfund, it makes you wonder whether this is the right path for everyone.

The truth is, it’s not. Some startups are just better suited going down the angel / VC route or aiming for profitability early.

A convenient alternative

Since the Seedrs crowdfund in 2022, we have found an easier way to fundraise. Every few months we email our 10,000+ members inviting them to invest into The Portfolio Collective. For those that want to, we process the legal paperwork through the SeedLegals platform as an Advance Subscription Agreement (ASA). This takes around 10 minutes of work per investor and the platform fee is only 1% of the amount invested, showing just how simple fundraising administration can really be.

You can learn more here.

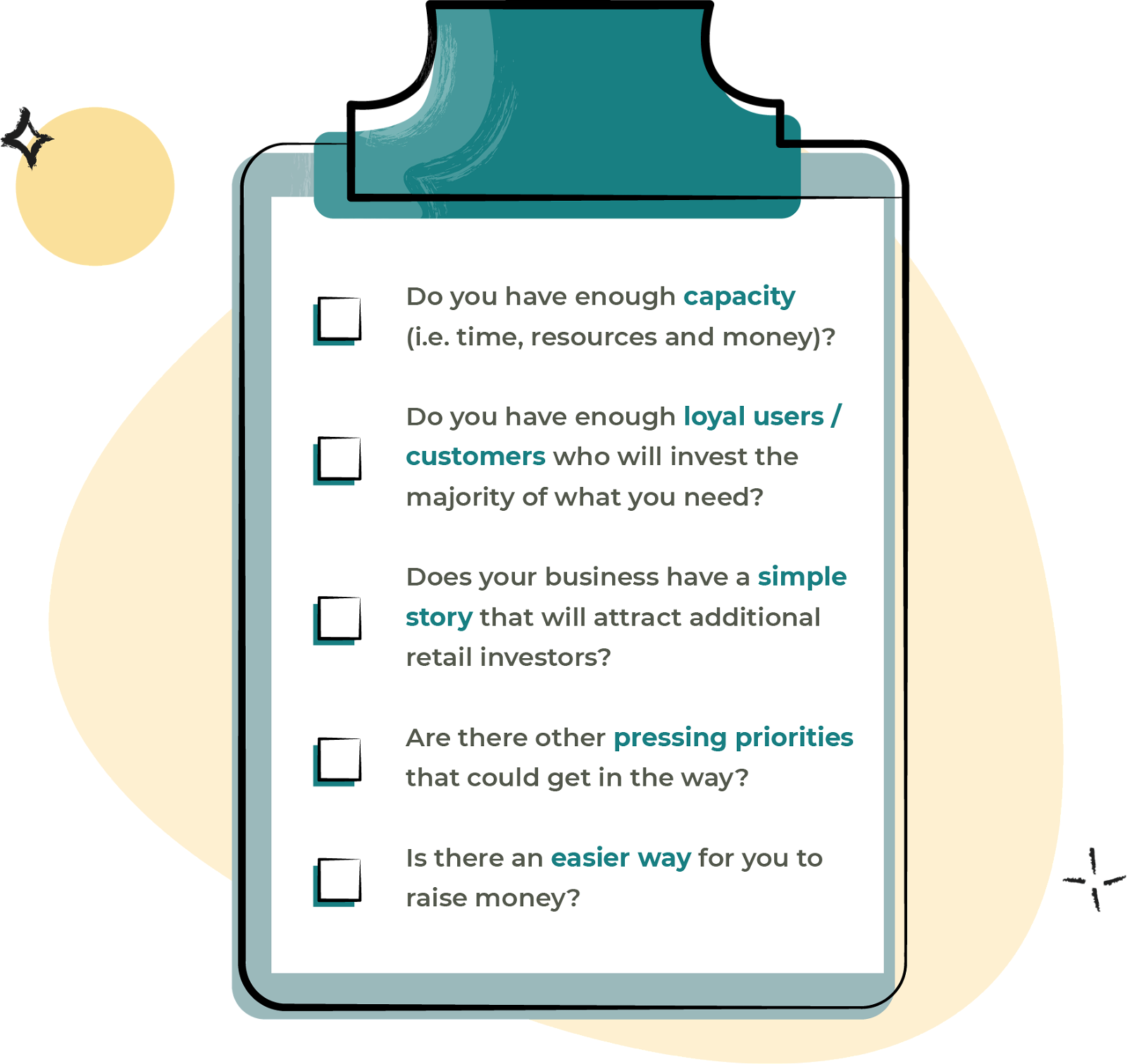

Still not sure if a crowdfund is right for you? Here’s a handy questionnaire to see if you’re ready

If you have additional insights and data points on this subject, feel free to comment or drop us a message – we’d love to hear your crowdfunding stories!

Think this sounds like the right path for you? Come along to our monthly Community Welcome Call for new members to find out what a portfolio career could look like and how The Portfolio Collective can help you take those first steps towards professional success – and don’t forget to connect with our community!

3 responses to “Are crowdfunds really worth it? Lessons learned from the trenches”

Really interesting article Ben. I have been looking at a crowd funding project and this insight comes just at the right time. Thanks for sharing

Great article @thebenlegg and shared on LinkedIn. Good stuff from the trenches debunking some of the bar talk.

Really interesting article. It’s great that you tracked it all. The thing that isn’t here, of course, is the cost of servicing the investor base over time. Some of the companies on Seedrs seem to have a a super needy user investor group.

For most companies, it’s about raising the money then getting on with the day job .I’d say that a lot of the marketing and comms work you did for this will have a strong payback for TPC over the medium to long term rather than just being purely an additional cost. I think the marcomms are much stronger now. You’re also already effectively monetising the experience. It adds value to the community and you could create a course and/or playbook around this.